Fighting the Tape(r)

- Chris O'Meara

- Sep 17, 2021

- 5 min read

Updated: Oct 19, 2021

Summary 1: Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Summary 2: Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

A key question we always try to ask is; what is our quarrel with price? Stated differently, what do we think we might know that the market does not already appreciate. On a macro or single stock basis, it could be considered profoundly bold arrogant to claim that we have a better insight than the prevailing bias. To be fair, markets can still be macro inefficient when asset prices diverge from un-derlying fundamentals for liquidity or emotional reasons. As we have often noted, the virtuous self- reinforcing cycle of credit and liquidity during an economic boom can cause a legitimate overshoot in asset valuations. Similarly, the withdrawal of liquidity during a crisis or recession can lead to an emotional overreaction and undervaluation on the downside. As investors, they only element we can really assess is the potential margin of safety and even that is conditional on future cash flows and balance sheets.

In the current episode, equity markets have clearly been supported by super-abundant liquidity. Indeed, the Fed’s policy settings (the monthly QE purchases and rates) are still at emergency levels designed for one of the greatest deflationary shocks in recent history. That no longer seems appro- priate with the S&P500 (the global risk proxy) just under the record high and most macro indicators (with the exception of payrolls) back to or above pre-pandemic levels.

Of course, the Fed has signaled that they will start the taper in November and finish in mid-which is slightly faster than the prevailing bias. The forward projections in the infamous dot plot also implied faster-than-consensus normalization on policy rates as well. Although the way price (in equities) has responded suggests that there is skepticism that the Fed will achieve this goal.

While Asian equities have generally corrected around the initial shift in policy from the Fed, the relationship between yields and Asian equities is more complex. The correction in 1994, 2004 and 2013 were in the 15-20% range. In the most recent episode, the 2013 taper announcement, was a (relative) shock to markets and the increase in real yields was a non-trivial and rapid 200 basis points (chart 1).

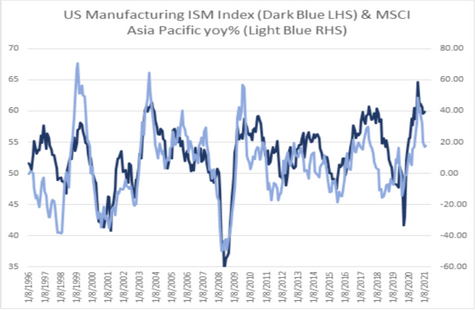

However, in the medium term, Treasury yields tend to be positively correlated to growth and profits. Therefore, if higher yields are accompanied by reflation and stronger growth, that is typically posi- tive for Asia and equities more broadly (chart 2). From our perch there have been four key challeng- es for Asian equities in the current episode; a) macro conditions have already passed peak growth; b) while the level of real rates remains extremely low, markets have also past peak liquidity support, especially in Asia where there has been a slowdown in the China credit impulse; c) China regulatory tightening has also clearly weighed on domestic and regional equities; and d) valuations started the episode from optimistic levels. Critically, further de-rating might be required to take the margin of safety back to an attractive level.

In conclusion, the good news is that macro vulnerabilities in South East Asia are less than in 2013. Moreover, Asia Pacific has already corrected by 13.5% from the February high (at the recent low in August) and the regulatory risk in China is now much more widely appreciated and priced (around 75% of MSCI China has already been affected). The bad news is that the North Asian markets appear more fragile from a leverage and valuation perspective and might experience further de-rating. US nominal and real yields have also started to move impulsively higher again over- night. From a tactical perspective that could lead to further upward pressure on the US dollar and downward pressure on liquidity beneficiaries globally and in the region. However, if yields rise because cyclical conditions are improving that is ultimately positive for equities and the region. An inexpensive diversifier is the banks which benefit from higher yields. That is part of our long exposure.

Disclaimer

Content contributed by Nick Ferres, Advisory Board Member of Conduit Asset Management Pte. Ltd. All information contained in this document is sourced from public source documents, media releases and not from Conduit Asset Management Pte. Ltd., (the “Company”). All due diligence onus, including and not limited to that related to legal and financial documentation, rests on the investor. This document is intended for distribution to “institutional investor” and "accredited investor" types as per definition by the Securities and Futures Act (Cap. 289) of Singapore, or to those who would qualify as such, under one or more of the categories of “institutional investor” and "accredited investor" so described therein. The information and data contained herein are strictly confidential and for information purposes only, and shall not be construed as investment advice, an offer, or solicitation, to deal in any securities. The information is not to be reproduced or transmitted, in whole or in part, to third parties, without the prior consent of the Company. This information is not directed at or intended for distribution to any person or entity who is a citizen or resident of, or located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject the Company to any registration or licensing requirement. This information has not been reviewed or authorized by the Monetary Authority of Singapore, or any regulatory authority elsewhere. Consequently, you should not act or rely upon the information contained herein without seeking professional counsel. The information contained herein may contain statements that are not purely historical in nature, but are “forward-looking statements”. This includes, among other things, projections, forecasts, targets, samples or proforma investment structures, portfolio composition models and hypothetical investment strategies. These forward-looking statements are based on certain assumptions and actual events may differ from those assumed. Neither the Company nor any of its respective affiliates make any representations as to the accuracy of these forward-looking statements or that all appropriate assumptions relating thereto have been considered or stated and none of them assumes any duty to update any forward-looking statement. Accordingly, there can be no assurance that estimated returns or projections can be realized, that forward-looking statements will materialize or that actual results will not be materially different or lower than those presented. Please note that the Company and/or its related companies, and investment staffs, may from time to time hold direct or indirect economic interests via non-controlling stakes into underlying Funds’ Investment Advisory Companies that control the Funds into which the Conduit Partners’ Capital Fund invests. Past performance is no guarantee of future results, and there is no assurance that the investment’s objectives will be achieved. In addition, certain financial information is contained herein. While the Company has made reasonable efforts to include information from sources that it believes to be reliable, the timeliness, accuracy and completeness of the underlying information, and any computations based thereon, cannot be assumed. While the Company has attempted to minimize errors, it has not verified, nor does it guarantee or warrant, the accuracy, validity, timeliness, completeness or suitability of such information and data. The Company is not responsible for any trading decisions, damages or other losses related to the information or its use. Please note that our references to a “Tradeflow USD/EUR Series” herein is made specifically to the CEMP – USD/EUR Tradeflow Fund, ISIN NUMBER: KYG1988M6375/KYG198751300. Conduit Pte. Ltd. is a part owner the referenced commodity trade finance fund’s investment advisor, Tradeflow Capital Management. The Company is currently invested in, and receives compensation for referenced Fund distribution and rebates on direct Fund investments from the Conduit Partners’ Capital Fund into the CEMP – USD/EUR Tradeflow Fund. For references to “VPAM Asian Macro” herein is made specifically to the “Vantage Point Asian Macro Fund”, the Company received compensation for the referenced Fund distribution and rebates from Vantage Point Asset Management Pte. Ltd.

Comments